In the case that you have some damage but not enough to make an insurance claim worthwhile your local roofing contractor can likely work out a repair plan with you and as always consult a public adjuster or your insurance agent if you have any questions about roofing insurance claims.

Make money hail damage claims roof.

Most states require a homeowner to make a claim within 30 60 days.

In many states usually where hail is less frequent a standard homeowners policy includes hail damage to a roof as part of your protection coverage.

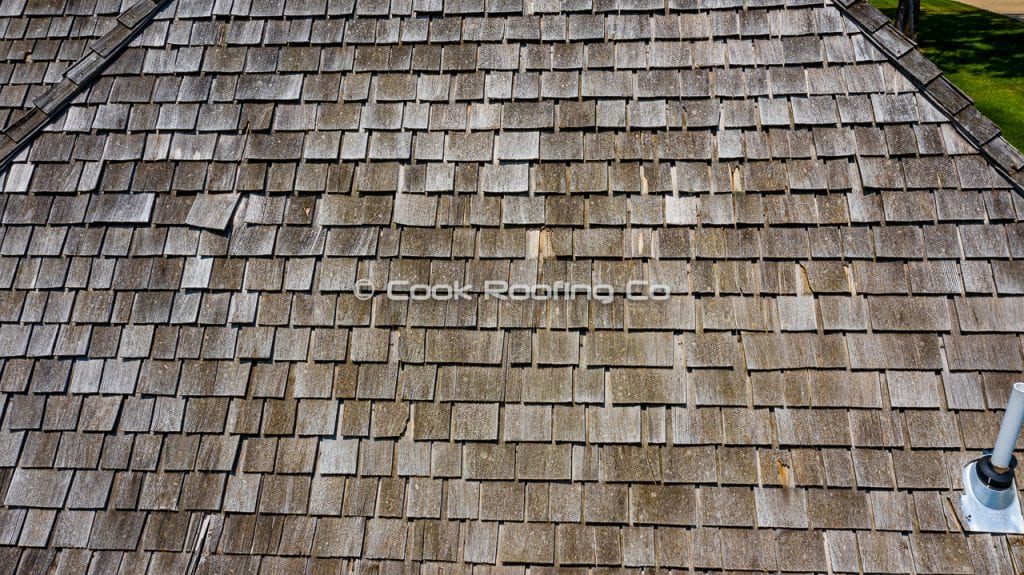

Conduct a thorough roofing inspection.

You can buy only actual cash value coverage for wind and hail damage if your roof is too old to qualify for replacement value coverage.

Set a time and date to discuss the claim with your insurance adjuster.

For example some insurers may pay 90 of all repairs and replacement costs for roofs aged 1 5 years.

When there is a high volume of claims the earlier you file the paperwork the sooner you will get your claim processed.

Here is the full process of making a roof hail damage insurance claim.

Indeed in most cases insurance providers consider visible damages as proof.

They can help decide whether there is enough damage to make a hail damage claim on your roof.

However to maximize the policy owners must additionally point out hidden damages.

Have the roof independently inspected document the damage.

Set an appointment to review the hail damage claim.

However they will only pay 30 of repairs and replacement costs for roofs aged 15 years and beyond.

Homeowners file a claim pay the policy deductible and then the insurer pays to fix the damage.

A deductible is the amount you have to pay toward a loss before your insurance company pays a claim.

Often hail damage roof insurance policies indicate that insurers pay a percentage dependent on your roof s age and condition.

Everything you need to know after a hail storm including hail damage roof inspections and how to file an insurance claim.

A repair estimate from a credible professional strengthens your odds of getting the amount you request and educates you on what it will cost to fix the damage.

Failure to make a timely claim is reason for claim denial.

Property owners often cite visible damages on their roof hail damage insurance claim.

Your insurance reimbursement will be based on the.

Once a claim has been filed it s on your record and depending on your insurance carrier could be there for 3 to 5 years.

When you make that call to your insurance agent or insurance company and request an adjuster to check your roof for damages a claim is filed on your homeowners policy.

These can also affect your insurance rates.